According to our recent research, in 2025, the beauty industry continues to transform rapidly – driven by digital innovation, sustainability goals, and shifting consumer expectations. As global tourism accelerates and local retail ecosystems mature, brands are rethinking how to balance their growth between different beauty distribution channels, including travel retail and domestic models.

At Weitnauer Group, we are proud to be a trusted, exclusive beauty distribution partner for renowned premium beauty brands. By combining our expertise in both travel retail and domestic channels, we gain a comprehensive understanding of how consumer behaviour, regulations, and retail formats evolve across global markets.

The Evolution of Beauty Distribution Channels

According to Weitnauer Group’s latest researches on global perfume and cosmetics trends, the beauty market reached USD 580 billion in 2024 and is projected to exceed USD 725 billion by 2030, reflecting a steady compound annual growth rate of 3.8% (Statista, 2024). From a distribution perspective, this growth is driven by the expansion of omnichannel networks, enhanced logistical capabilities, and greater integration between domestic and travel retail markets:

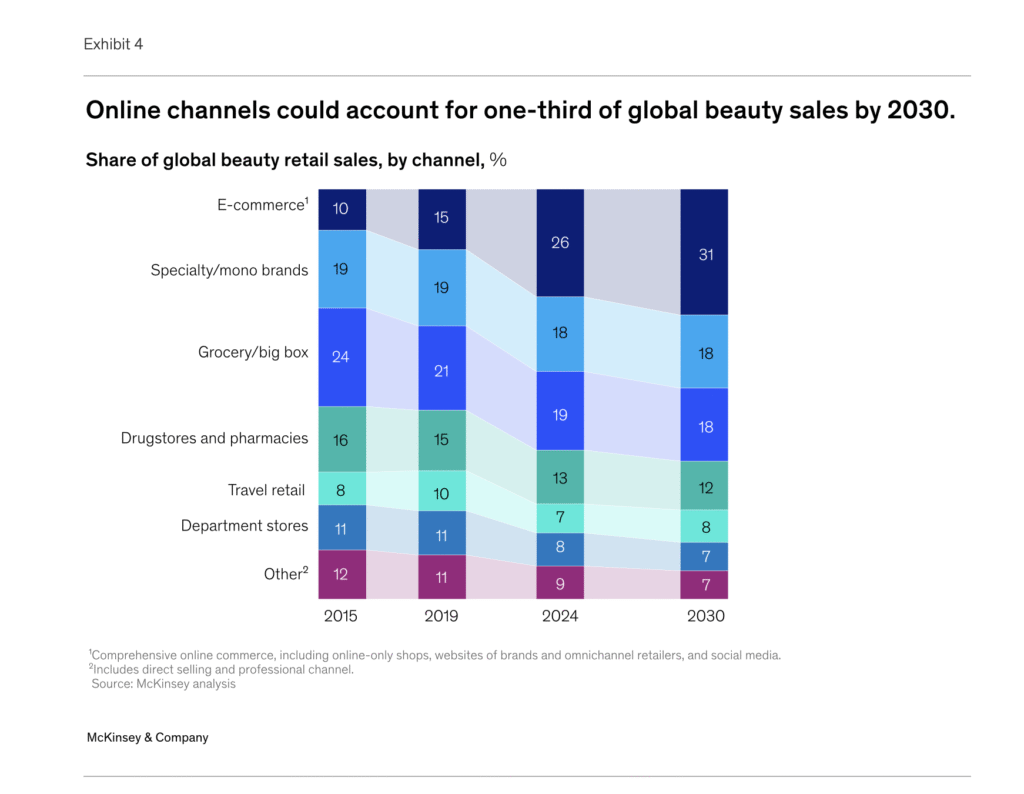

- Travel retail contributed roughly 7% of global beauty revenues in 2024 (Graph 1, McKinsey, 2025). However, according to Weitnauer Group’s previous studies, the beauty segment remains the largest within the Perfume & Cosmetics category, representing 31.4% to 41.7% of the total global travel retail market (Grand View Research, 2024).

- In contrast, domestic sales dominate with 92% of total revenues, powered by e-commerce expansion, convenience-driven purchases, and rapid digitalization (McKinsey, 2025).

Together, both channels reinforce a balanced and interconnected beauty ecosystem—where global reach and local presence define the next phase of market development.

Three core forces underscore the distribution shift:

- Digital omnichannel expansion.

- In 2024, global air traffic rose 10.4% year-on-year, surpassing pre-pandemic levels by 3.8% (IATA, 2024).

- Increasing sustainability and traceability expectations.

Key Advantages of Beauty Distribution in Duty Free

- Visibility: Global passenger traffic reached a record 9.4 billion travelers in 2024, an 8.4% year-on-year increase and 2.7% above pre-pandemic levels (2019), reinforcing airports as key touchpoints for beauty brand visibility and emotional engagement (ACI, 2025).

- Impulse-driven growth: According to our previous article, about 60% of travelers purchase beauty products duty-free because of exclusivity and savings without ant plans.

- Global prestige: Travel retail reinforces luxury brand desirability.

Domestic Beauty Distribution: The Power of Local Markets

There are multiple benefits of entering local markets with beauty products, including:

- Retention:

Around 70% of consumers repurchase from the same brand each quarter (NielsenIQ, 2024). This highlights the value of retaining customers, which is significantly more cost-efficient than continuous acquisition. - E-Commerce Scale:

Online beauty accounts for 26% of global category revenue (McKinsey, 2025), reflecting the growing importance of digital presence and omnichannel distribution. - Localization:

Brands can adapt product formulas and positioning to regional preferences — from climate and skin tone to cultural beauty rituals — creating stronger consumer relevance.

However, as outlined in Weitnauer’s previous analyses of the perfume and cosmetics sectors, regional differences play a crucial role in shaping success. Thus, when entering a new market, brands must adapt their distribution strategy to align with local regulations, retail structures, and consumer behaviour.

All these elements can be effectively managed by a trusted distributor.

With operations across four regions — MEA, CIS, Europe, and the Americas — Weitnauer Group relies on local teams who deeply understand consumer trends, market dynamics, and regulatory frameworks, ensuring seamless market entry and sustainable brand growth.

Comparing Consumer Behaviour: Travellers vs. Local Beauty Shoppers

| Behavior | Travel Retail Consumers | Domestic Shoppers |

|---|---|---|

| Motivation | Exclusivity, convenience, gifting | Routine purchases, loyalty, ethics |

| Avg. Spend | Average spend in the Skincare category is US$95 (DFNI, 2024) | Depends on the region: $211.82 – Average American expenditure on beauty products (Demand Sage, 2025) |

| Age Range | 25–44, Millennials and Gen Y | 18–60, all demographics |

| Preferred Categories | Fragrance, premium skincare | Everyday skincare, makeup |

| Top Decision Factors | Fragrances remain the most impulsive purchase category in travel retail, often driven by exclusive offers and limited editions. In contrast, skincare purchases tend to be more planned (DFNI, 2024) | Ingredients, sustainability |

Conclusion

While travel retail consumers are primarily driven by exclusivity, convenience, and gifting, domestic shoppers prioritize routine purchases, loyalty, and ethical considerations. Spending patterns also differ: the average skincare purchase in travel retail is USD 95, whereas domestic consumers, particularly in the U.S., spend an average of USD 211.82 on beauty products annually.

The travel retail audience, largely composed of Millennials and Gen Y (25–44), tends to favour fragrances and premium skincare, with purchases often influenced by limited editions and special deals. Conversely, domestic buyers, spanning a broader demographic range, focus on everyday skincare and makeup, guided by ingredients, sustainability, and long-term brand trust.

Together, these two segments highlight the dual nature of the global beauty market – one driven by emotional impulse and exclusivity, the other by habit, transparency, and consistency.

A Borderless Beauty Future

The divide between travel retail and domestic beauty markets is narrowing. Travel retail drives aspiration and visibility; domestic distribution builds long-term loyalty. The next frontier lies in merging both through omnichannel strategies, sustainability leadership, and precise consumer analytics.

Weitnauer Group, with our travel retail pioneering experience and position as an international B2B distributor continues to redefine how beauty brands grow across markets. By bridging global ambition with local execution, we transform distribution into a strategic partnership — one that combines visibility, loyalty, and long-term brand equity.

As the boundaries between travel retail and domestic beauty markets continue to blur, Weitnauer Group remains at the forefront of this evolution — connecting global reach with local trust to build a truly borderless beauty future.