At Weitnauer Group, we continue our Category Trends Series, exploring how each of our six core product categories evolves across global markets.

Previously covered segments include:

Our next focus is the trends in cosmetics sector — a category defined by rapid innovation, shifting consumer expectations and regulations, and growing sustainability demands.

Through our long-standing partnerships with leading beauty brands, Weitnauer Group has direct visibility into the market’s ongoing transformation.

In this edition, we highlight the key forces shaping the cosmetics industry in 2025, including:

- Growth forecasts and investment outlook across key regions

- Regional dynamics influencing market entry and expansion

- Innovation drivers in product formulation, technology, and packaging

Key Cosmetics Segments and Market Share

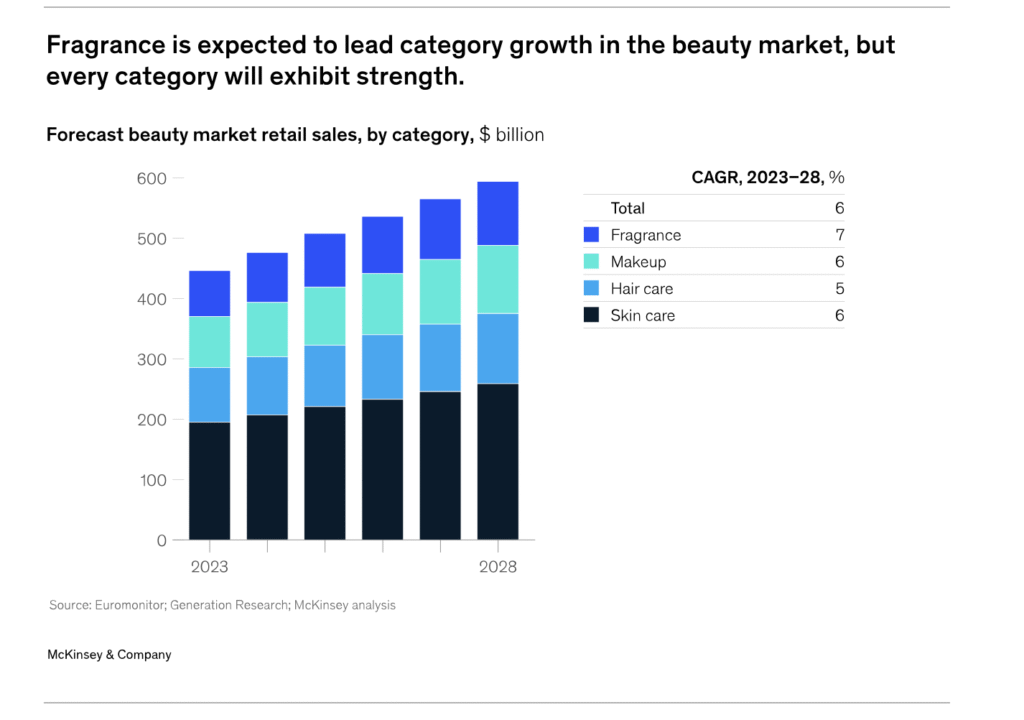

The global beauty market is divided into three main product segments: skincare, haircare, and makeup. However, as highlighted by McKinsey & Company (2024), each category demonstrates distinct growth dynamics and market weight.

According to the research, skincare dominates the global beauty landscape, accounting for over 44% of total market value, while makeup represents approximately 17% (Graph 1. Source: McKinsey, 2024).

To summarize:

- Skincare – the fastest-growing and largest segment, driven by demand for active ingredients.

- Haircare – the second-largest category, supported by innovations in scalp health, natural ingredients, and functional formulations.

- Makeup – a dynamic segment shaped by inclusivity, hybrid textures, and the rise of skincare-infused beauty products.

Global Market Snapshot: Cosmetics Industry Size and Forecast

According to Fortune Business Insights, the global cosmetics sector is projected to reach approximately USD 629.7 Billion by 2033 (Imarc, 2025)

Which Regions Influence Cosmetics Distribution the Most?

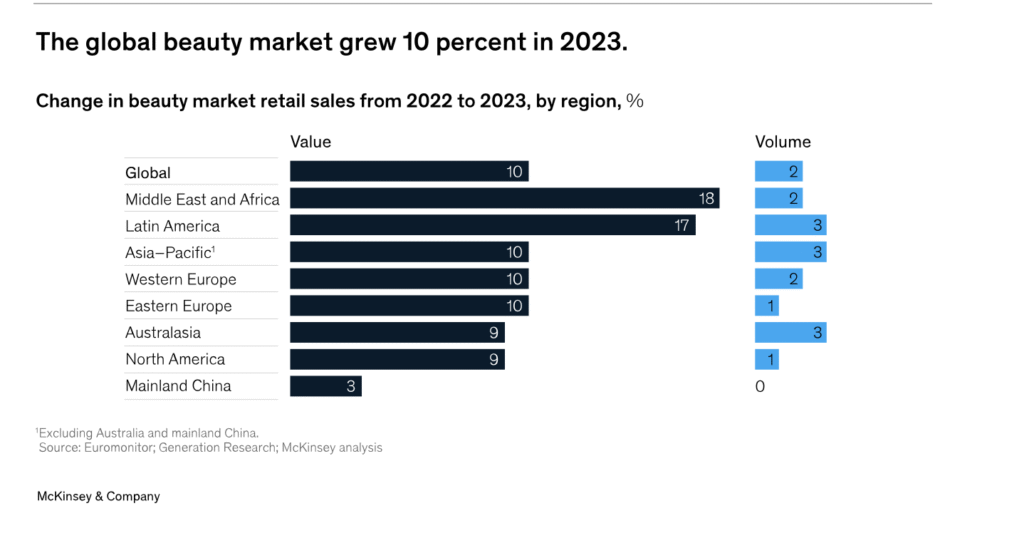

Although Europe remains the most mature and established cosmetics market — holding the leading position in global beauty exports by value (Graph 2). However, recent McKinsey research shows that over the past decade, the Middle East & Africa and Latin America have recorded the fastest growth rates in both value and volume (Graph 3), while the Asia-Pacific region continues to rank second in terms of export value (Worlds top Exports, 2025).

in 2023. Source: World Integrated Trade Solution

This indicates that each of these regions merits a closer examination of its unique trends and market dynamics, which are outlined in the sections below.

Europe: The Most Mature and High-Margin Cosmetics Market

Europe remains the globally dominant export cosmetics market in 2025, accounting for 48.4% of global exports, thanks to its combination of strict and transparent regulations, a strong emphasis on innovation, a reputation for high-quality products, and a large, established manufacturing base. European consumers drive sustainability and premiumization trends (Cosmetics Europe, 2025).

| Parameter | Cosmetics Market |

|---|---|

| Market Size & Growth | According to Market Forecast, 2025, market: – estimated at USD 108.5 Billion in 2024. – projected to reach USD 136.6 Billion by 2032, growing at CAGR of 6.36%. |

| Segmentation | – Growth led by skincare with active ingredients for anti-aging and hydration (retinol, niacinamide, vitamin C) (Fortune Business Insights, 2025) |

| Consumer Trends | – Premiumization (Premium Beauty News, 2025). – Renovation for Niche Demographics: Gen Z, menopausal women, gender-neutral and inclusive beauty lines (Premium Beauty News, 2025). – Rising Demand for Organic and Sustainable Products: (Statista, 2025). – Growth of E-commerce and Direct-to-Consumer (DTC): (Fortune Business Insights, 2025). |

| Distribution Channels | – Department stores, pharmacies, speciality retailers – Rapidly expanding e-commerce and DTC sales |

| Export & Import | – Germany, UK, Italy = largest importers – Significant sourcing of premium ingredients & finished goods (Statista, 2025) |

| Market Drivers | – Transparency in formulations – Eco-conscious and ethical production – Growth of digital engagement & DTC models |

To sum up:

- Europe continues to be the most mature cosmetics market, setting global benchmarks for quality, innovation, and craftsmanship.

- Market value: USD 335.9 billion (2024) → USD 556.2 billion (2032).

- Skincare, inclusivity, and clean beauty are key growth drivers shaping future demand.

- Core markets — France, Germany, Italy, Spain, the UK, and the Nordics — define global standards, with France remaining the world’s top beauty exporter and EU trade flows maintaining steady growth.

Asia-Pacific: The Largest and Fastest-Expanding Cosmetics Market

Asia Pacific dominated the cosmetics market with a 30% of share in 2024, driven by rapid urbanization and a growing middle-class population with increasing purchasing power, consumers are showing a stronger preference for high-quality and premium cosmetic products (Euro Monitor, 2025).

| Parameter | Cosmetics Market |

|---|---|

| Market Size & Growth | According to TechSci Research, 2025, market: – USD 139.67 billion in 2024 and is expected to reach USD 186.34 billion by 2030 |

| Segmentation | – Skin care with approx. 43% revenue share (Grand View Research, 2023). – Fastest Growing – Hair Care (Grand View Research, 2023) |

| Consumer Trends | Preference for premium, local culturally authentic brands, dermocosmetics, wellness & clean beauty, AI personalization, youth-driven demand (Mordor Intelligence, 2025) |

| Distribution Channels | Dominated by e-commerce platforms (Shopee, Douyin, TikTok), livestreaming, supplemented by offline retail (Mordor Intelligence, 2025) |

| Export & Import | South Korea leads exports (~USD 8.6B); China largest importer (~USD 13B) (Indexbox, 2025) |

| Market Drivers | Rising disposable incomes, urbanization, middle class expansion, digital commerce, influence of K-beauty & J-beauty, sustainability awareness (TechSci Research, 2025) |

To sum up:

- Asia-Pacific is the largest cosmetics market

- Skincare dominates the market, driven by K-beauty and J-beauty innovations, with consumers favoring premium, personalized, and sustainable products.

- Digital commerce through platforms like Shopee, Douyin, and TikTok, powered by influencer marketing and livestreaming, is a major distribution channel shaping consumer buying.

- Core markets include China (largest market), South Korea, Japan, India.

The Americas: Innovation and Technology

The North American cosmetics market is a vibrant and rapidly evolving sector driven by increasing demand for premium, personalized skincare products, rising consumer awareness of clean and sustainable beauty, and technological advancements such as AI diagnostics and virtual try-ons.

| Parameter | Cosmetics Market |

|---|---|

| Market Size & Growth | North America: USD 76.56B in 2024, expected USD 127.1B by 2034 (CAGR 5.2%) (Research and Markets, 2025) Latin America: USD 23.32 billion in 2024 to USD 41.13 billion by 2033 with a CAGR of 6.51% (Market Data Forecast, 2025). |

| Segmentation (Demographic) | Female segment -largest; male grooming rapidly growing – Income: premium and clean beauty preferred by middle to upper income groups (Research and Markets, 2025) |

| Consumer Trends | – Clean, transparent beauty with ethical sourcing – Tech-enabled beauty: AI diagnostics and AR try-ons – Multifunctional products – Inclusivity with broad shade ranges – Mental wellness integration into beauty rituals (Euromonitor, 2025). |

| Key Markets | US and Canada dominate North America; Brazil and Mexico lead Latin America; rising markets in Argentina and Colombia (Euromonitor, 2025). |

| Export & Import | Imports focused on premium skincare and makeup in North and Latin America; local production rising (Euromonitor, 2025). |

| Market Drivers | Innovation, premiumization, sustainability, digital engagement, e-commerce growth (Research and Markets, 2025) |

Weitnauer’s expansion into Uruguay has reinforced its omnichannel support for existing operations in Brazil and Paraguay within the perfume and cosmetics sector. This strategic move enhances regional integration by uniting sales channels, strengthening customer engagement, and optimizing supply chain efficiency. With this growth, Weitnauer is well positioned to capture rising consumer demand and unlock new opportunities across key Americas markets.

Africa: A Rapidly Growing Emerging Market

The African perfume and cosmetics market is driving significant growth through a combination of rising disposable incomes, expanding middle and millionaire classes, and strong cultural connections to scent and beauty.

| Parameter | Africa Cosmetics Market |

|---|---|

| Market Size & Growth | USD 3.87B in 2024, projected USD 7.02B by 2033, CAGR 6.85% (Market Data Forecast, 2025) |

| Segmentation (Demographic) | Market characterized by strong female consumer base, male grooming rising; preference for natural, ethnic-specific formulations and traditional ingredients (Mordor Intelligence, 2025) |

| Consumer Trends | Growing demand for clean, organic, and sustainable products; emphasis on skin care (39.27% revenue share) featuring indigenous botanicals like marula and baobab oils; rising interest in pollution defense and anti-aging products; digital retail and social media impact especially in Nigeria and South Africa (Market Data Forecast, 2025) |

| Key Markets | South Africa largest market (27.5% of revenue), Nigeria rapidly expanding with youthful demographics (Beauty Africa, 2025) |

| Export & Import | Increasing local manufacturing; imports mainly premium products; market challenges include distribution inefficiency and regulatory complexity (Mordor Intelligence, 2025) |

| Market Drivers | Rising disposable incomes, urbanization, middle-class growth, tech-enabled retail (e-commerce), increased awareness of self-care, and cultural affinity for beauty and grooming (Market Data Forecast, 2025) |

Weitnauer Group is actively expanding in Africa’s perfume and cosmetics market by representing well-known premium brands. Read more about African Perfume Market.

Key Trends Regional Summary Shaping Cosmetics Market in 2025

- Europe: The most mature market globally, Europe leads in setting regulatory standards and sustainability, with a strong shift towards premiumization, niche demographics, and advanced e-commerce platforms driving modest growth.

- Asia-Pacific: The largest and fastest-growing cosmetics market, propelled by rapid urbanization, rising middle-class incomes, and digital commerce innovation, with dominant trends in premium skincare, cultural authenticity, and AI personalization.

- Americas: Characterized by technological innovation and inclusivity, North and Latin America emphasize clean, transparent beauty, AI diagnostics, multifaceted products, and expanding male grooming markets fueled by e-commerce and influencer marketing.

- Africa: A rapidly emerging market driven by rising disposable incomes, indigenous ingredient-based products, youthful demographics, and expanding digital retail channels overcoming traditional distribution challenges.

Regulation and Compliance in Perfumes and Cosmetics

The cosmetics industry faces evolving regulatory frameworks aimed at consumer safety, ingredient transparency, and environmental protection. Key regulatory trends in 2025 include:

- Ingredient Transparency

- Sustainability Mandates

- Advertising Restrictions

- International Compliance

Weitnauer Group assists partners in staying compliant by closely monitoring regional regulations and adapting distribution strategies accordingly. For a deeper dive into evolving global perfume and cosmetics regulations shaping 2025, explore the comprehensive guide by Weitnauer Group here: Perfume and Cosmetics Market Regulation 2025.

How Weitnauer Group Navigates Cosmetics Market Trends

The global beauty market’s growth is driven by premiumization, skincare innovation, digital omnichannel expansion, sustainability, and rising consumer demand across emerging regions such as Asia–Pacific, the Middle East, and Latin America.

At Weitnauer Group, our expertise and strong partnerships with global luxury beauty brands enable tailored go-to-market strategies aligned with regional nuances and evolving consumer demands. We ensure product integrity, regulatory compliance, and premium consumer experiences (Our Brands).