At Weitnauer Group, our Category Trends Series tracks how each of our six core product categories evolves across markets.

In the previous edition on cosmetics, we framed the sector as one of rapid innovation – shaped by shifting consumer expectations, regulations, and sustainability demands – and outlined the forces defining 2025: growth outlook by region, regional market-entry dynamics, and innovation drivers across formulation, technology, and packaging.

In today’s article, we build on that foundation. We focus on one of the strongest cross-regional forces shaping cosmetics right now: K-Beauty and broader Asian beauty culture — and how they are redefining product development, consumer expectations, and distribution strategies.

Asian beauty by country: what it means for distributors

Asian beauty culture isn’t one country’s playbook. It’s a regional innovation system that distributors now need to read as a portfolio:

- Korea: fast trend cycles and rapid product development cycles, “routine formats” (steps, kits, minis), export-ready educative storytelling and natural ingredients (Special Chem, 2020; Long Story, 2025)

- Japan: minimalist skincare contrasts with layered K-Beauty routines: fewer steps, refined formulations, trust-led claims, and sensorial quality. (ILEM Japan, 2025)

- Southeast Asia: climate-first routines shaped by humidity, UV exposure, and heat (light textures, high-wear SPF, oil-control, soothing actives) (V 10 Plus, 2024).

- China: heritage ingredients plus a high-velocity social commerce ecosystem and creator-led discovery (FMI, 2025)

K-Beauty became the most exportable layer of this ecosystem because it travels as products + education: it teaches consumers what to use, in what order, and why. That matters for distribution because education reduces trial friction and increases basket size.struc

Top Global Exporters of Asian Beauty Brands (K/J/C-Beauty)

Asian beauty is no longer a regional phenomenon. It is a global export engine, driven by a small group of countries.

South Korea: the global scale leader in Asian beauty exports

South Korea is the world’s leading exporter of Asian beauty and the undisputed engine behind K-Beauty. In 2024, Korean cosmetics exports exceeded $10.2B, spanning skincare and color cosmetics shipped to 172 countries (Korea Net, 2025).

On a global level, South Korea now ranks as the second-largest cosmetics exporter worldwide ahead of the United States (8.1%), Germany (6.2%), and China (5.3%). Only France remains ahead, with a 15.9% share (Behalf Korea, 2025).

China: volume-driven C-Beauty with regional strength

China is the second-largest Asian beauty exporter by volume, shipping around 347K tons of cosmetics with an export value of $4.1B (Index Box, 2025). C-Beauty is anchored in heritage ingredients, local manufacturing scale, and a strong link to social commerce ecosystems.

China’s export strength is most visible in Southeast Asia and MENA, where value positioning, cultural proximity, and fast retail rollout support continued growth (Index Box, 2025).

Japan: premium J-Beauty built on minimalism and trust

Japan remains a key exporter of Asian beauty through J-Beauty, shipping approximately $4.28 billion of cosmetics in 2023.

Export growth is increasingly focused on China, South Korea, and Thailand, positioning Japan as a premium counterbalance to fast-cycle K-Beauty within the Asian export portfolio (Deep Market Insights, 2025).

Top Global Importers of Asian Beauty Brands (K/J/C-Beauty)

Asian beauty today is not defined by trends alone. It is defined by export capacity, regional specialisation, and trade discipline — and the countries leading production are shaping the future structure of the global cosmetics market.

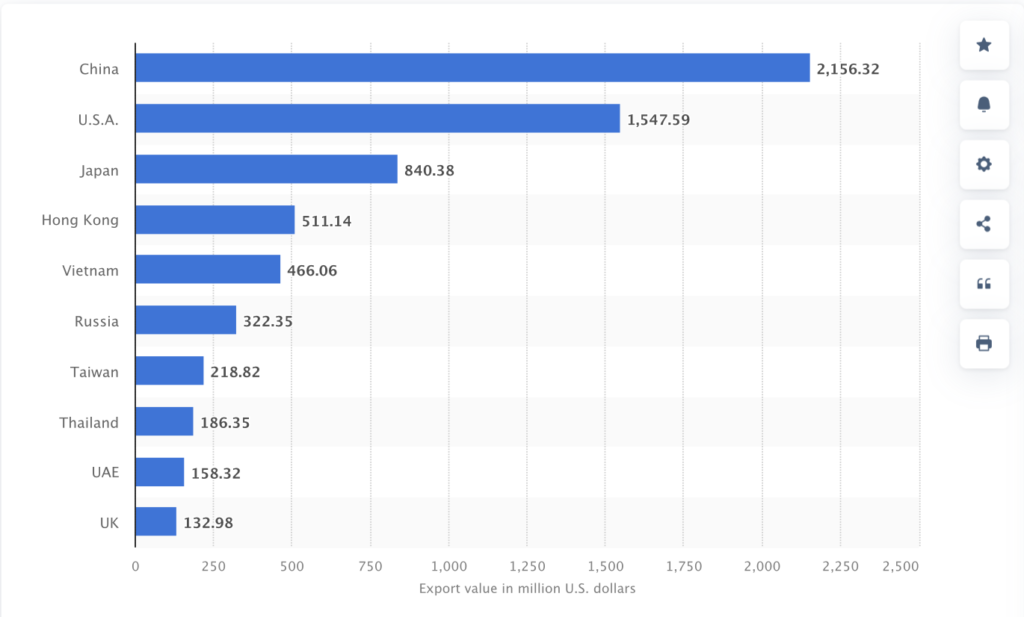

- Asia-Pacific: Dominates as the top region for imports of K-beauty and J-beauty, led by China ($2.2B+), Hong Kong, Japan, Vietnam, Thailand and Taiwan, capturing over 60% of South Korean cosmetics exports (CosmoProf Asia, 2025).

- North America: US leads as the second-largest importer ($1.5B+ for K-beauty in 2024), with rapid growth surpassing China in some quarters due to mainstream retail adoption (Cosmetic Design Asia, 2025; Statista, 2025)

- Europe + MENA: Europe (France, Germany, UK, Russia, Poland) holds ~34% of K-beauty exports, while UAE ranks top-10; combined as a high-growth “blue ocean” region (Behalf Korea, 2025).

Why K-Beauty matters more than a “trend shelf”

As K-Beauty continues to influence global beauty markets through changes in product innovation, retail models, and consumer behavior. For distributors, understanding retail and product trends in leading exporter countries is essential to anticipating market shifts. This is why K-Beauty trends deserve closer attention.

K-Beauty is a repeatable system: skin-barrier-first routines, layered steps, lightweight textures, and fast innovation cycles – powered by education-led content and social commerce conversion (Vogue, 2025).

That system aligns with the strongest growth engine in beauty: skincare. In our broader cosmetics overview, we highlighted that skincare dominates global beauty value (over 44%), while makeup represents ~17% – a split that helps explain why skincare innovation now sets expectations for the whole category, from claims and actives to packaging and replenishment behaviour.

Retail signal: Boots-linked reporting notes that one K-Beauty product was sold every 15 seconds in 2025, with Beauty of Joseon highlighted as a best-seller. (Who What Wear, 2025)

How K-Beauty Is Reshaping the Market: 5 Structural Shifts

- Barrier-first claims. K-Beauty popularized “skin barrier” literacy, shifting global formulations toward actives that prioritize repair over aggressive treatments (Asiance, 2025)

- Routine as value unit. Brands sell layered systems , boosting multi-SKU baskets, repeat purchases and routine merchandising in retail and online (Special Chem, 2020)

- Skin-like makeup hybrids. Demand pivots to the categorise that combine the coverage of makeup with the active ingredients and benefits of skincare (B Futurist, 2025)

- Accelerated trend cycles. Rapid detect-launch-refresh model shortens shelf life; distributors need agile sensing, test-repeat cadences and exit strategies (Long Story, 2025).

- K-Beauty leverages e-commerce and social commerce for explosive U.S. growth, with TikTok Shop demos converting billions of views into impulse sales of cushions, patches and hybrids (Spray, 2025).

Regional implications through a distribution lens

- Europe: wins when K-Beauty meets high expectations for compliance and stricter regulatory frameworks (as discussed in the previous article), transparency, and sustainability (Future Market Insights, 2025).

- Asia-Pacific: it’s an innovation engine shaping textures, routines, and digital commerce behavior (Future Market Insights, 2025).

- Middle East: premium fusion opportunity — lightweight layering that performs in heat/UV, backed by trust signals and luxury cues (Future Market Insights, 2025).

- Americas: social commerce drives trial; retail partnerships drive scale. Export momentum into the U.S. validates long-term shelf potential beyond virality.

- Africa: as skincare-led growth and digital retail expand, education-first routines can create strong trade-up pathways.

Strategic K-Beauty Playbook for Global Growth

- Localise by climate first. UV, heat, humidity, pollution change shape “best-seller”.

- Build a hero-to-routine ladder. Lead with one high-intent hero, then expand into routine items to grow repeat purchase.

- Treat compliance as growth infrastructure.

- Control channels to protect brand equity. Grey market and counterfeits erode brand equity faster than any underperforming campaign. That’s why distributors play a critical role in market protection – through rigorous supply chain audits, strict channel controls, and well-structured exclusive distribution rights.

- Make education part of the product. That’s exactly where Training Services and Retail Excellence make the difference – turning routines into consistent in-store execution. With our teams on the ground, we help standardize the experience across channels, uplift conversion, and protect long-term brand equity.

When working with distributors, brands win through regional nuance, disciplined compliance, channel control, and retail excellence — turning trend velocity into sustainable sell-through.

Weitnauer Group’s core category is Perfumes & Cosmetics, and we continue to expand our brand portfolio across markets and channels, including K-Beauty Brands, – with execution that protects and grows brand equity, as well as drives consistent execution on local markets.