Inspired by our recent cross-category trend articles on perfumes and cosmetics, one pattern stands out: premiumisation is the most distinct driver shaping growth in this category in 2026. Thus, we are launching a new article series on premium beauty distribution, bringing together Weitnauer Group’s on-the-ground expertise of working with premium perfume & cosmetics brands and the latest industry insights. Across the series, we will answer four core questions:

- What defines premium beauty today?

- Who consumes premium beauty now — and how do they buy?

- Why does exclusive distribution matter for premium beauty brand equity?

- And how can premium beauty brands scale through distribution without diluting perception?

In this article, we define what characterises premium beauty brands, how they differ from mass and masstige segments, and which categories show the highest growth potential without compromising performance, perception, or consumer expectations.

Redefining Premium Beauty: Is It All About the Price?

Premium beauty is no longer defined by exclusivity, packaging, and price. Today, premium status cannot be earned without quality and results.

Evidence supports this shift. “Only 14% of U.S. beauty buyers believe higher prices indicate better quality” — Larissa Jensen, Circana Circana, 2025. Instead, premium perception is increasingly driven by:

- Proven performance: visible outcomes that justify the spend through the clinical testing (Cosmetics Beauty, 2025)

- Transparency: 71% are willing to pay more for clarity on sourcing and ingredients (National Retail Federation, 2020)

- Wellness rituals: drive 64% of beauty market growth via emotional self-care connections (NIQ State of Beauty, 2025)

Brands that rely on pricing without evidence quickly lose trust – because in premium beauty, price may signal positioning, but performance sustains it.

Mass vs. Masstige vs. Premium Beauty Brands Comparison

Price is no longer a reliable proxy for beauty quality. But it remains a practical — and still powerful — way to segment the market. The more relevant question today is what actually correlates with price across tiers:

- Role of price: High in mass (60%+), moderate in masstige (30–40%), low in premium (14%) (Circana H1 2025).

- Ingredients: Mass skews toward synthetics; masstige blends efficacy-led actives; premium increasingly biotech-led (90%+) (Coherent Market Insights 2025).

- Innovation: Incremental in mass, trend-following in masstige, technology-enabled in premium (AI/AR) (NIQ Global Beauty Edit 2026).

- Loyalty: Lowest in mass (40%), building in masstige (50%), strongest in premium (64%), where routines reinforce retention (NIQ State of Beauty 2025).

As we see, loyalty strengthens as beauty moves up the price spectrum. In the mass segment, loyalty remains low, driven by price sensitivity and ease of switching. Masstige represents a clear inflection point, where consumers balance perceived quality with aspiration, resulting in growing repeat behaviour. Premium shows the highest loyalty, anchored in emotional connection, rituals, and long-term routines – making it the most stable and sticky segment.

Seamless Switch Between Mass and Premium

Consumers move between mass and premium more fluidly than ever, combining both in their routine (McKinsey, 2025). The switch becomes “seamless” when premium upgrades deliver visible payoff without friction- same convenience, better outcome (Beauty Independent, 2022).

Compromise becomes difficult when products tie to identity, confidence, or high-sensitivity results.

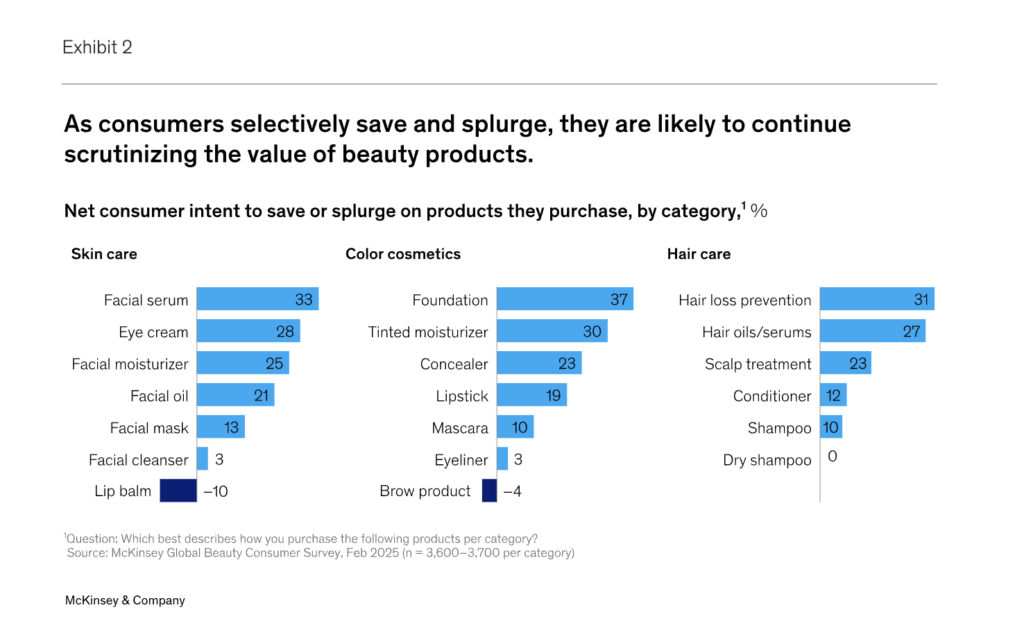

According to McKinsey research, in every major beauty category — skin care, color cosmetics, and hair care — there are sub-categories where consumers are unwilling to compromise on spend. Rather than trading down across the board, consumers are selectively saving and splurging, carefully scrutinising value at the sub-category level and prioritising products where performance, confidence, or problem-solving impact is most tangible (McKinsey, 2025).

Where consumers splurge (highest upgrade pressure):

- Skin care:

- Facial serum +33

- Eye cream +28

- Facial moisturiser +25

- Color cosmetics:

- Foundation +37

- Tinted moisturiser +30

- Concealer +23

- Hair care:

- Hair loss prevention +31

- Hair oils/serums +27

- Scalp treatment +23

Where consumers compromise (low / negative upgrade pressure):

- Skin care: Facial cleanser +3, lip balm -10

- Color cosmetics: Eyeliner +3, brow product -4, mascara +10 (still relatively low)

- Hair care: Shampoo +10, conditioner +12, dry shampoo 0

Winning Premium Beauty Sub-Categories 2025

Circana’s H1 2025 data proves that performance is no longer evenly distributed across categories: momentum concentrates in sub-categories that deliver either immediate emotional value or visible, problem-solving outcomes, while others stabilise or soften despite continued consumer engagement.

| Category | Prestige Sales (H1) | Growth | Key Drivers (as stated by Circana) |

|---|---|---|---|

| Fragrance | $3.9B | +6%(fastest) | New launches contributed nearly one-third of fragrance dollar gains; EDP/parfums; minis/travel +15% units |

| Haircare | $2.3B | +6% | Scalp care +19%; styling posted a double-digit lift; launches strongest in treatments |

| Makeup | $5.2B | +1% | Lips +3% (hybrid formats); eye makeup improved, driven by mascara growth |

| Skincare | $4.6B | -1% | Masstige skincare grew double-digits; prestige body continued to thrive |

Fragrance and haircare clearly lead premium growth, outperforming the prestige average through identity-driven consumption (fragrance) and treatment-led efficacy (scalp and hair solutions). Makeup shows early signs of stabilisation, supported by hybrid formats, while skincare softness at prestige level masks strong demand in adjacent segments such as masstige and body care.

Segment context

| Segment | Sales | Growth | Notes |

|---|---|---|---|

| Prestige beauty | $16.0B | +2% | Fragrance and haircare outpaced the prestige average |

| Mass beauty | $34.6B | +4% | Mass fragrance was a standout (+17%) |

At a market level, prestige beauty continues to grow more slowly than mass, but with higher value concentration. The data confirms that premium success in 2025 is not about blanket premiumisation, but about focusing on the right categories, price architecture, and consumer use-cases that justify trade-up.

What this means in practice:

- Premiumisation is function-led, not brand-wide.

- Consumers pay up where benefits are visible, confidence-driven, or problem-solving.

- “Basics” (cleanse, shampoo, balm, brow) stay commoditised and price-sensitive.

Distributor implication:

- Build premium growth around treatment and complexion heroes (serums, foundation, scalp/hair-loss, oils).

- Protect margin with trade-up architecture (good/better/best, minis, bundles, regimen sets).

- Manage basics for availability, scale, and price-pack strategy, not storytelling.

In the next article, we take a closer look at premium beauty consumers — who they are, how they shop, and how their behaviours are evolving.

Takeaways (Q&A)

What defines premium beauty today?

Premium beauty is defined by proven performance, transparency, and emotional value – not by price, packaging, or exclusivity alone.

How does premium differ from mass and masstige?

Mass scales through accessibility, masstige through “luxe-for-less” cues, while premium relies on efficacy, ethics, and selective distribution.

When do consumers upgrade from mass to premium?

Consumers trade up where outcomes are visible and meaningful — serums, complexion, fragrance, scalp care, and treatments.

Where do consumers compromise more easily?

In low-differentiation basics such as shampoo, conditioner, lip balm, brow products, and basic cleansers.

Which premium beauty categories are growing fastest?

Fragrance and haircare lead premium growth, while skincare faces increasing masstige pressure.

What enables seamless mass-to-premium switching?

Trial access, proof at decision points, routine continuity, omnichannel ease, and transparency.